The smart Trick of Medicare Graham That Nobody is Discussing

The smart Trick of Medicare Graham That Nobody is Discussing

Blog Article

Not known Details About Medicare Graham

Table of ContentsSome Known Details About Medicare Graham Some Known Factual Statements About Medicare Graham The Best Guide To Medicare GrahamThe 10-Minute Rule for Medicare GrahamGet This Report about Medicare Graham

An individual that joins any one of these policies can give power of attorney to a trusted person or caretaker in instance they become unable to manage their affairs. This suggests that the person with power of lawyer can administer the policy on behalf of the strategy holder and see their medical details.

The Best Guide To Medicare Graham

Make sure that you comprehend the extra advantages and any kind of advantages (or freedoms) that you may lose. You might want to consider: If you can change your present medical professionals If your medicines are covered under the strategy's medicine list formulary (if prescription medicine coverage is offered) The regular monthly costs The cost of insurance coverage.

What extra solutions are supplied (i.e. preventative treatment, vision, dental, gym subscription) Any kind of treatments you need that aren't covered by the strategy If you want to enlist in a Medicare Advantage plan, you should: Be eligible for Medicare Be signed up in both Medicare Component A and Medicare Part B (you can inspect this by referring to your red, white, and blue Medicare card) Live within the plan's service location (which is based upon the region you live innot your state of residence) Not have end-stage renal illness (ESRD) There are a few times during the year that you might be qualified to alter your Medicare Advantage (MA) plan: The happens every year from October 15-December 7.

Your new coverage will start the very first of the month after you make the button. If you need to change your MA strategy beyond the standard enrollment durations defined above, you might be eligible for a Special Registration Duration (SEP) for these certifying occasions: Moving outdoors your strategy's insurance coverage location New Medicare or Part D strategies are readily available due to a relocation to a brand-new permanent place Just recently released from jail Your strategy is not restoring its contract with the Centers for Medicare & Medicaid Solutions (CMS) or will certainly stop supplying benefits in your location at the end of the year CMS may likewise establish SEPs for sure "exceptional conditions" such as: If you make an MA enrollment demand into or out of an employer-sponsored MA strategy If you wish to disenroll from an MA strategy in order to sign up in the Program of Extensive Care for the Elderly (PACE).

The Best Strategy To Use For Medicare Graham

resident and have actually ended up being "lawfully present" as a "qualified non-citizen" without a waiting duration in the United States To verify if you're qualified for a SEP, Medicare.contact us. Medicare West Palm Beach.

Second, check out monthly costs and out-of-pocket expenditures. Establish just how much you can spend based on your budget plan. Third, consider any type of clinical solutions you may require, such as confirming your existing physicians and specialists accept Medicare or locating coverage while away from home. Finally, review concerning the insurer you're thinking about.

The Single Strategy To Use For Medicare Graham

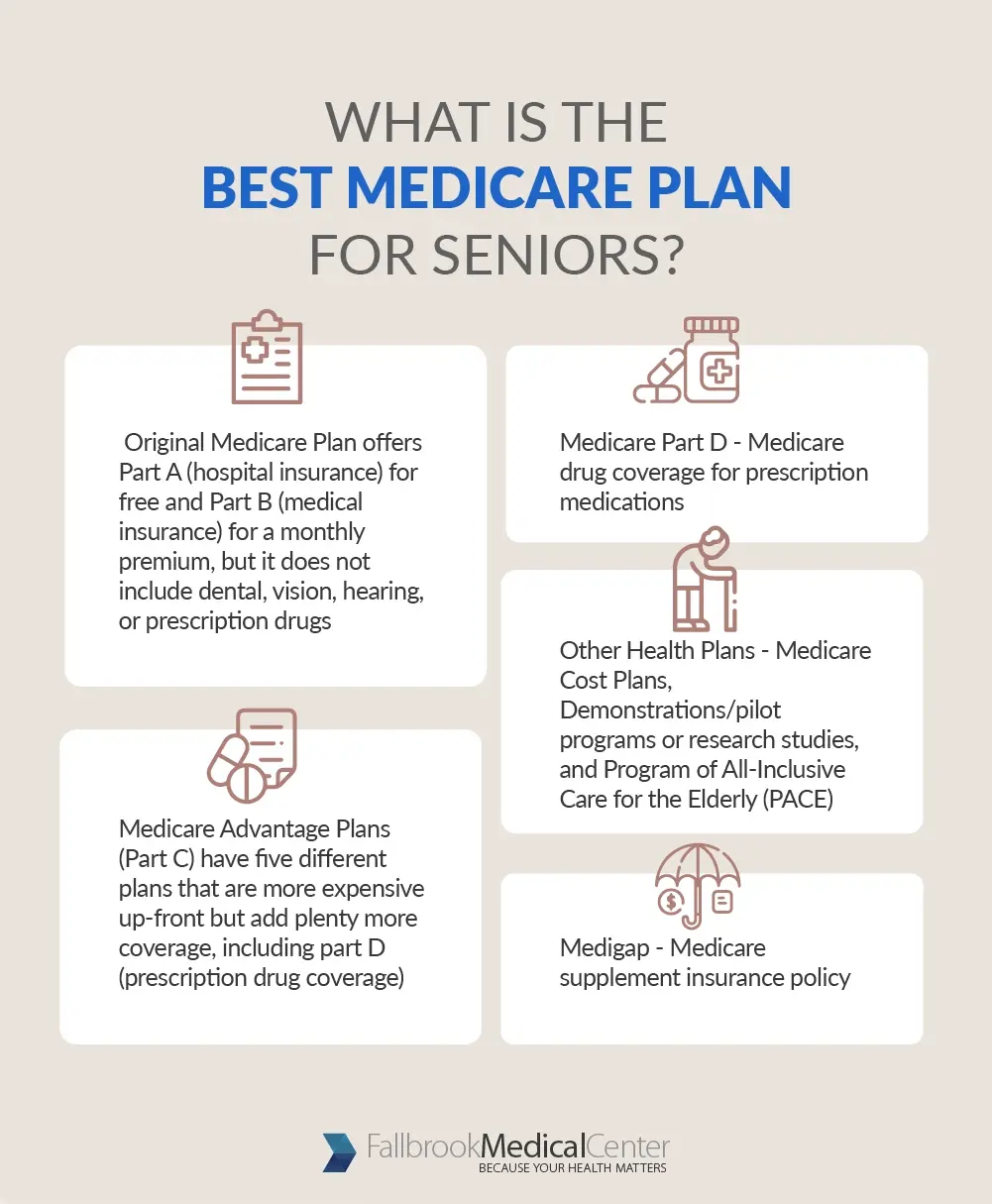

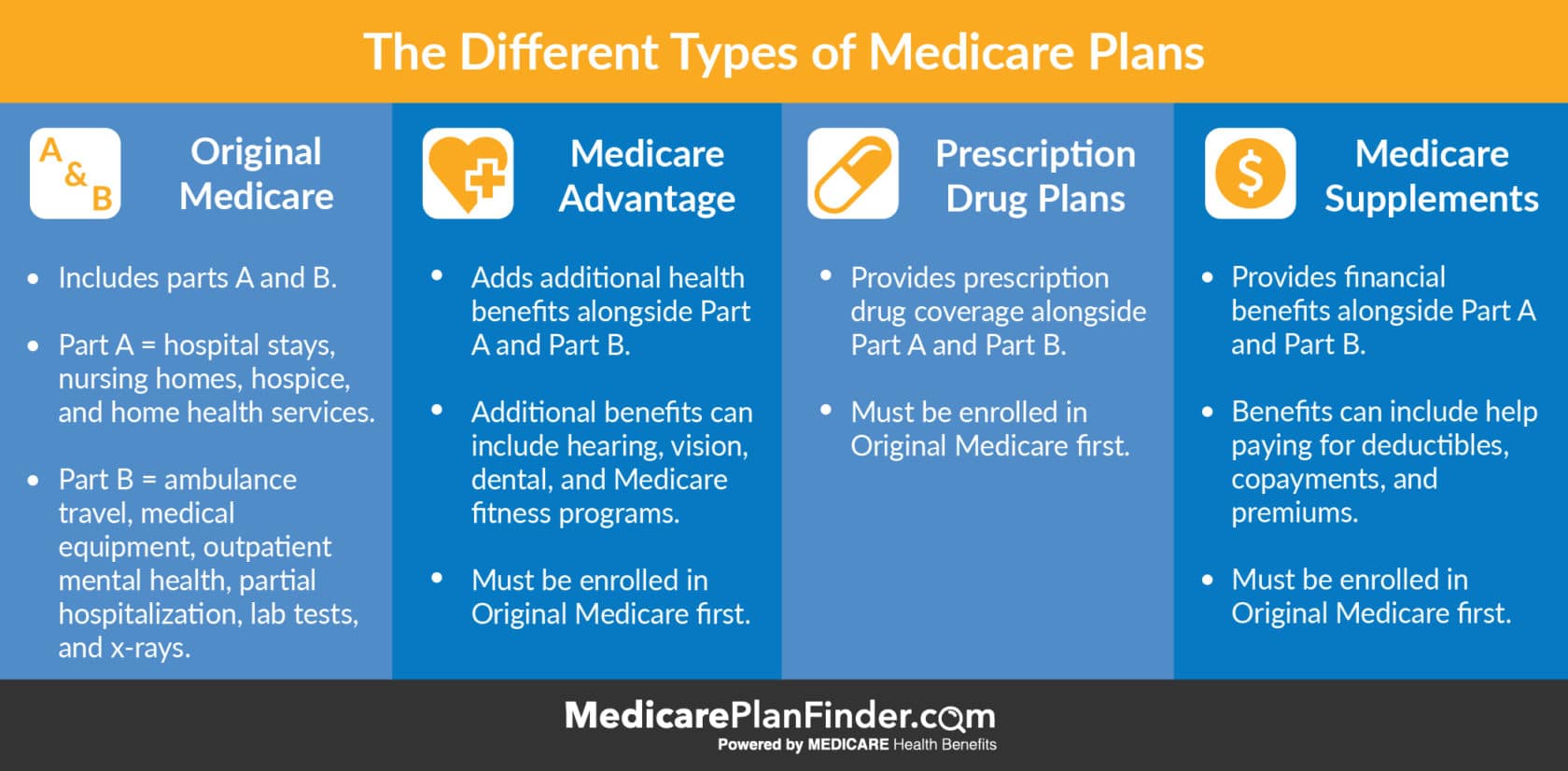

To pick the best coverage for you, it's vital to recognize the basics concerning Medicare. We've accumulated whatever you require to recognize regarding Medicare, so you can choose the plan that ideal fits your needs.

Medicare supplement strategies are streamlined right into courses AN. This classification makes it much easier to contrast several additional Medicare plan types and select one that finest fits your requirements. While the fundamental benefits of each sort of Medicare supplement insurance strategy are consistent by service provider, premiums can differ in between insurance policy companies.: Along with your Medicare supplement strategy, you can select to purchase added protection, such as a prescription medicine plan (Component D) and dental and vision protection, to help fulfill your specific More Help needs.

You can locate a balance in between the plan's expense and its coverage. High-deductible strategies offer reduced premiums, yet you may have to pay even more expense. Medicare supplement plans commonly have a steady, foreseeable costs. You pay a monthly premium for reduced or no extra out-of-pocket prices.

More About Medicare Graham

Some plans cover foreign travel emergencies, while others exclude them. Provide the clinical solutions you most value or may need and make certain the plan you select addresses those needs. Personal insurance provider use Medicare supplement plans, and it's recommended to review the fine print and compare the value various insurance firms use.

It's always a great idea to talk to representatives of the insurance policy companies you're considering. Whether you're switching Medicare supplement plans or purchasing for the very first time, there are a few points to take into consideration *.

Report this page